Unlock More, Pay Less: No Closing Cost Home Equity Special*

Thinking about home improvements, consolidating debt, or tackling those unexpected expenses? Now’s the perfect time to tap into your home’s equity—without the usual upfront costs.

You'll save up to $1300! Hurry, ends November 30th.

*Pay no closing costs on any new HELOC when you apply between 10/01/2024-11/30/2025. Subject to credit approval. Offer good on new loans/lines only. For Home Equity Loans current rates range from 7.00% APR to 9.50% APR. As of 10/1/2025, the WSJ Prime Rate is 7.25%. Current rates across all markets range from Prime - 0.50% (currently 6.75%) to Prime + 2.00% (currently 9.25%). The minimum APR will never go below 2.75% and the maximum APR will not exceed 18%. Late payment charge after 10 days is 5% of payment amount. Property must be primary residence in the state of Ohio. NMLS #433809.

Jacob Fraylick Achieves Major Milestone: Strengthening Our Investment Services Team

We are proud to announce that Jacob Fraylick has officially obtained his Life Insurance and Securities licenses. These licenses were earned after passing a series of rigorous exams, including the Securities Industry Essentials (SIE), the General Securities Representative Exam (Series 7), and the Uniformed Combined State Law Exam (Series 66). His accomplishment has solidified his expertise and allowed him to step into his new role as a Financial Consultant. It also marks a significant step forward for both Jacob’s professional development and the continued growth of OUCU Investment Services.

These licenses require in-depth knowledge of financial markets, investment products and strategies, regulatory compliance, and ethical considerations. Over several months, Jacob built his expertise through a rigorous self-study program and hands-on experience in his role as an Investment Services administrative assistant.

In his new role as a Financial Consultant, Jacob can now help members with a broader range of financial planning needs—from investment advice to retirement strategies to life insurance solutions.

"Turning stress into confidence is my favorite part of any appointment. I find it rewarding to see members leave my office with renewed hope and encouragement toward reaching their financial goals," Jacob commented about his new position.

Please join us in congratulating Jacob Fraylick on this exciting achievement! We’re thrilled to see the positive impact he will have on the lives of our members.

Congratulations, 2025 Crewson Scholarship Recipients!

Three high school seniors each received a $3,000 Harry B. scholarship. Crewson Freshman Scholarship. This scholarship is awarded to graduating high school students who will attend Ohio University and who have demonstrated excellence in community activities and academic achievement

Mary Glascock of Athens High School plans to major in conservation biology and art. Mary is the child of Stephanie Miller and Jake Glascock.

Max McDonald is a Nelsonville-York senior who will study chemistry. His parents are Arelle and Daniel McDonald.

Leah Swatzel of Athens High School plans to major in communications. Leah is the child of Elizabeth and Phillip Swatzel.

Our new Lancaster office is open!

We’ve been your trusted financial partner in Athens County since 1955. We’re excited to expand and share our mission with our neighboring community.

As a not-for-profit, our goal is to make financial services accessible and affordable and to serve local communities. We look forward to bringing one-on-one banking and lending to our friends and family in Fairfield County as we spread our mission to go above and beyond to help our members live their best lives.

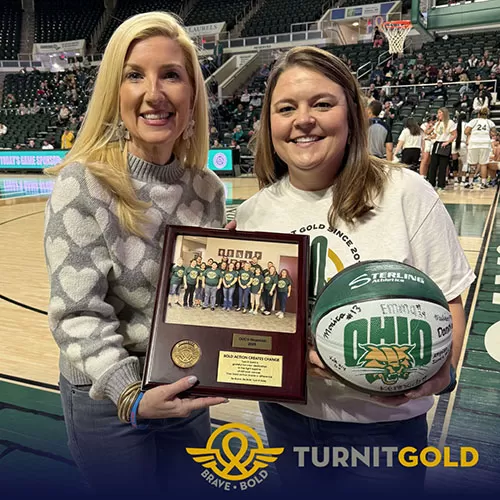

OUCU Receives the BOLD Award from Turn It Gold

Brave individuals inspire others. Bold action creates change.

We were thrilled to receive the BOLD Award from Angela Dina, the founder of Turn It Gold for being a strong partner with the Turn It Gold Foundation since 2018.

OUCU COO Danita Sharp accepted the award at Ohio University’s Women’s Basketball Game last Saturday. Turn It Gold is a nonprofit with the mission to accelerate the discovery of cures for childhood cancer through cancer research using a platform of Athletic Activism.

Money raised funds childhood cancer research through the Children’s Oncology Group and Greehey Children’s Cancer Research Institute.

Exciting News!

We're thrilled to announce the appointment of Wes Harkins and Tracy Mischelle Kelly to the OUCU Financial Board of Directors! They step into the roles previously held by retiring members Bob Courtney and Butch Hill, who will now serve as an Emeriti Board member.

Wes brings over a decade of experience in financial services, having held key roles at Nationwide Insurance focusing on strategy and process optimization. His work in pediatric cancer research fundraising has made a significant impact, achieving record-breaking results year after year. A consultant with Nationwide, Harkins was born in Athens and raised in Vinton County. He holds a BA in Health and Fitness Management from Capital University.

Tracy is the Executive Director of the Fairfield Medical Center Foundation and Board Secretary for The Friends of Fairfield County Board of Developmental Disabilities. A two-time Ohio University alumna, Tracy was the first Student Trustee selected from a regional campus and is a recipient of the United Campus Ministry Social Justice Award. She holds a BA in English and History and a master’s in public administration from Ohio University.

We’re excited to welcome Wes and Tracy to the board! Their expertise and dedication will undoubtedly help us continue to grow and serve our community.

OUCU voted Best Financial Institution in Athens!

A BIG thanks to our members for voting OUCU the Best Financial Institution 5 years in a row!

It’s an honor to serve you; our employees work hard each and every day to earn your trust.

We’re fortunate to live in such a supportive community. We love our members!

OUCU Financial Welcomes Snider Stroh Jarrett Financial

OUCU Financial announced that it has acquired Snider Stroh Jarrett Financial “Snider Stroh Jarrett”, one of Athens area’s largest providers of financial planning services, investments and insurance. Snider Stroh Jarrett consists of 3 financial advisors – Mark Snider, Dan Stroh and Shane Jarrett – and 3 support staff who have joined the OUCU Investment Services team. The financial advisors will continue to operate out of their home office on Depot Street in Athens.

“We are pleased to announce that we have joined OUCU Financial and have onboarded to the LPL Financial platform,” said Snider, who served as senior financial advisor at Snider Stroh Jarrett. “When we began looking for the best succession plan for our clients and stability for our long?term and best?in?class staff, OUCU Financial was a logical choice. By partnering with OUCU Financial and leveraging the robust LPL Financial platform, we can continue to provide our clients with personalized advice, outstanding service and a broad array of financial investments – the three things on which we have built our reputation over the past 50 years, and which we are planning as a legacy for the next 50 years.”

“We are honored to partner with such an esteemed and talented group of financial advisors as they continue to offer excellent advice to our community,” said Cory Corrigan, CEO of OUCU Financial. “Mark and I worked together tirelessly over the past 18 months to be sure that the cultures aligned, intentions were pure, and most importantly, that clients would benefit from this transition. With OUCU’s 20 years of experience in the Wealth Management business, almost nearly 70 years of shared solid commitment to the communities we serve, and ultimately helping members live their best financial lives, we believe that we can continue to provide clients with the same incredible service but with a stronger foundation that ensures it continues well into the future.”

OUCU Phone Banking: Account Access 24/7

2023 will bring a major expansion in banking capabilities and this Credit Union is all about it!

To kick off this year, OUCU has made accessing your accounts even easier with Phone Banking, an automated, dial-in way to quickly perform account transactions with voice or touchtone commands. A convenient and secure way to manage your money, anytime, nights, weekends, and even holidays from right where you are!

There's no waiting in line with Phone Banking!

• Check account balances. Hear recent and pending activity - such as deposits and withdrawals

• Transfer funds between your OUCU accounts; Loan account information - such as balance, payoff amount, and make payments

• Change your Phone Banking PIN and other account preferences

• Speak to eBranch Call Center banking specialist during business hours

OUCU Achieves Exceptional Performance Designation

BauerFinancial, Inc., the nation’s premier bank and credit union rating firm, announced that OUCU, has once again earned its highest (5-Star) rating for financial strength and stability. Earning a 5-Star rating indicates OUCU excels in areas of capital adequacy, profitability, asset quality and much more. Earning and maintaining this top rating for 47 consecutive quarters, means OUCU has done so continuously since August 2008. This achievement has secured an even higher designation for OUCU as an “Exceptional Performance Credit Union”. This title is reserved for institutions that have earned Bauer’s top 5-Star rating for 40 consecutive quarters (ten years) or longer.

OUCU is the only credit union in the area to be awarded a 5-Star rating.

“Embracing their ‘People Helping People’ core value,” notes Karen Dorway, president of BauerFinancial, “the nation’s credit unions are well-positioned to help local communities thrive. In fact,” she continued, “credit unions are local small businesses themselves, and their employees are members. Through shared experiences, they know exactly what other members need, and they have the means to help provide it. This has proven a winning combination for OUCU.”

Quick Pay Loan Payment Service

You can now make an OUCU loan payment inside or outside of online or mobile banking!

Make a payment from your:

• OUCU account

• account with another institution

• selected credit or debit card

• external transfers

BEWARE OF FRAUDSTERS

Fraudsters never give up and neither do we! Beware of phone calls that appear to be coming from the credit union. We will never call you and ask you for your card number, member number, SSN or PIN. Never give out personal information to someone who calls you.

If there is suspicious transaction on your credit or debit, you may need to verify a purchase with a yes or a no, but we will never ask for your card information.

Read more about fraud prevention tools from OUCU.

"You guys are the best! Always fast, friendly and very informative. Why go anywhere else – we will always look to OUCU Financial for our financial needs."

OUCU Member