Paycheck Protection Program (PPP) Loan Application

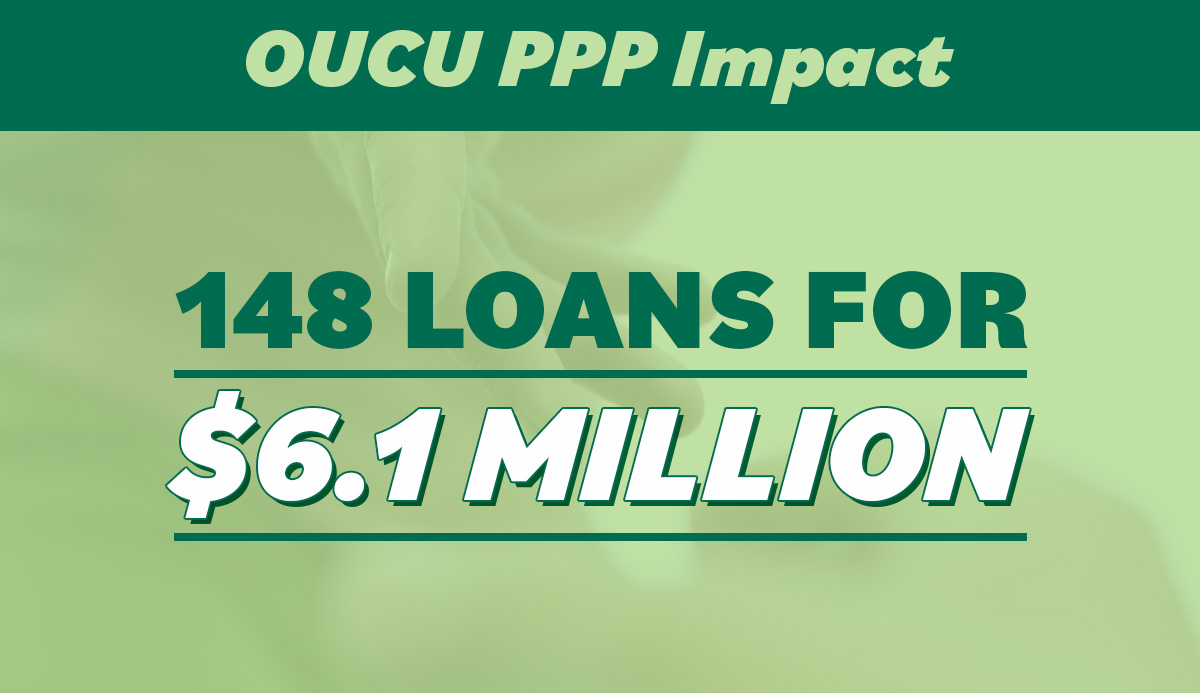

Paycheck Protection Program (PPP) Funding

Paycheck Protection Program (PPP) Funding

The U.S. Small Business Administration is no longer accepting new PPP applications from banks and credit unions.

The only institutions permitted to accept applications are designated as a Community Financial Institution (CFI).

A CFI is one of 4 special types of lenders: Community Financial Development Institution, Minority Depository Institution, Community Development Corporation, and a microloan intermediary.

OUCU will make an announcement if the application process opens back up again.