GETTING STARTED

1. Let’s get started:

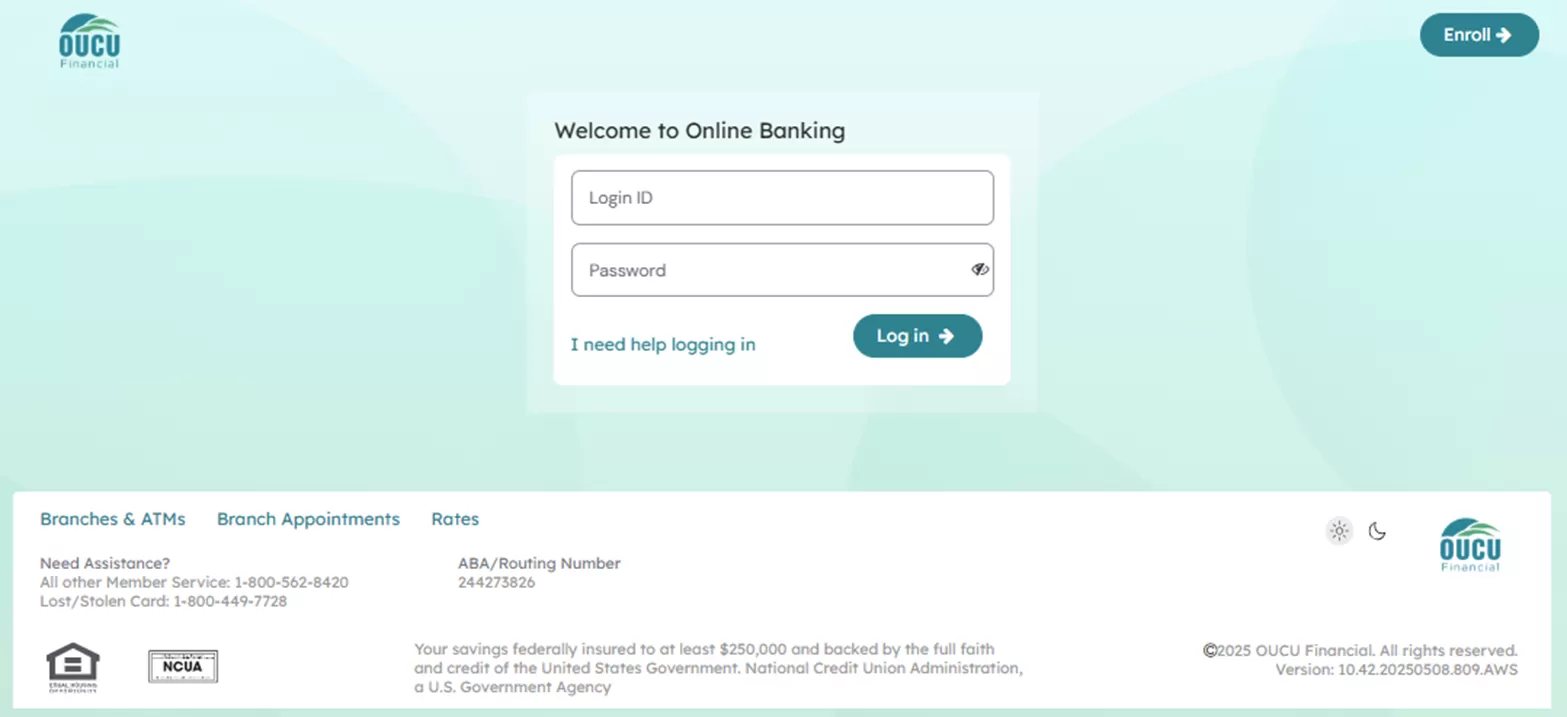

• Through online banking at OUCU.org (click LOGIN in the upper right corner) — OR —

• Download the NEW OUCU Banking App, following one of the instructions below depending on your device:

• DELETE your current “OUCU” mobile banking app

2. Continue based on the one scenario below that best describes you:

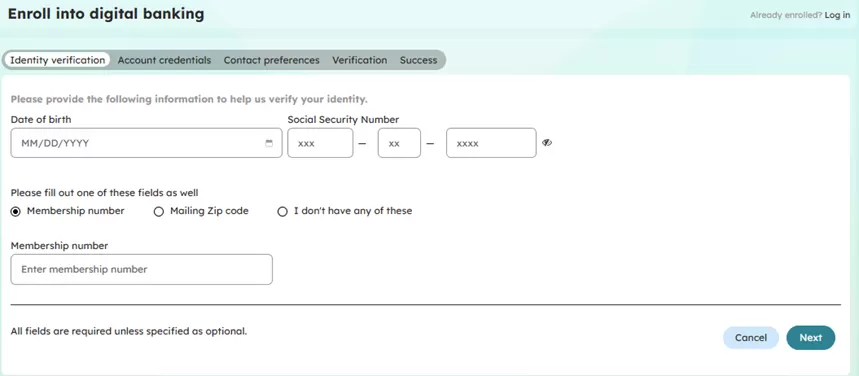

• This is your first time using online or mobile banking:

• Select Enroll

• Check the consent to terms and conditions for digital banking

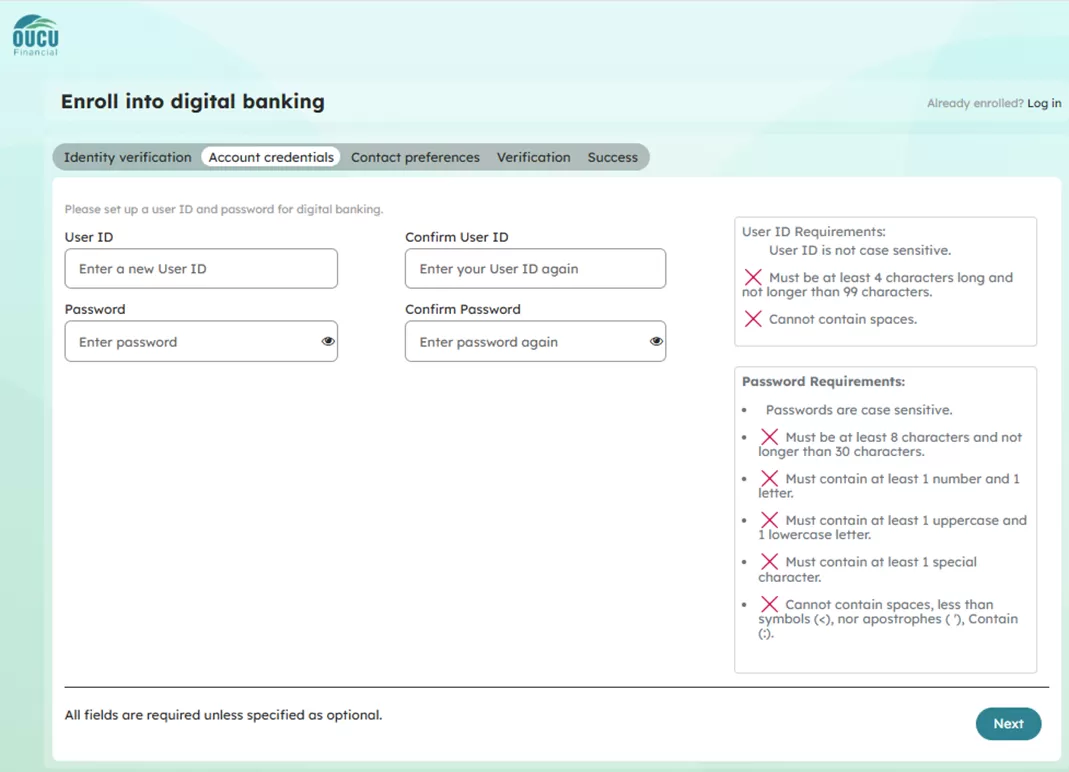

• Complete the required fields:

User ID Requirements:

• User ID is not case sensitive.

• Must be at least 4 characters long and not longer than 99 characters.

• Cannot contain spaces.

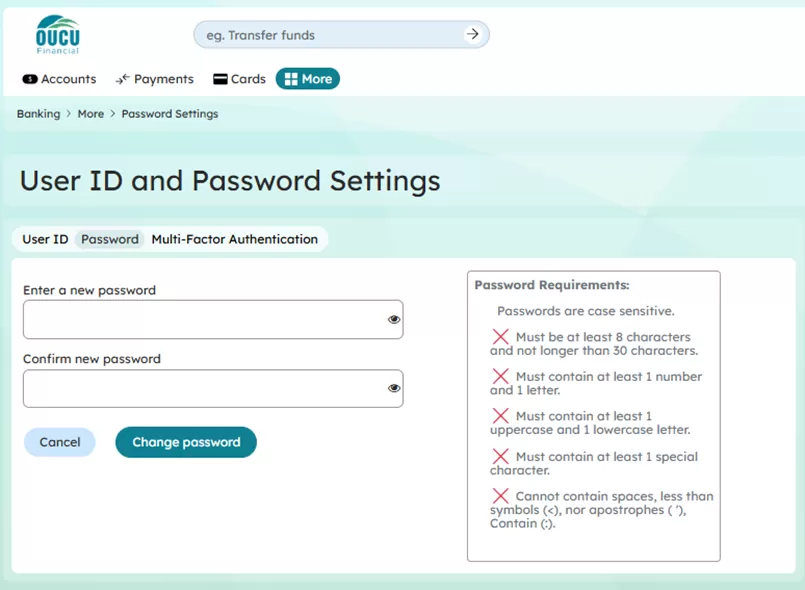

Password Requirements:

• Passwords are case sensitive.

• Must be at least 8 characters and not longer than 30 characters.

• Must contain at least 1 number and 1 letter.

• Must contain at least 1 uppercase and 1 lowercase letter.

• Must contain at least 1 special character.

• Cannot contain spaces, less than symbols (<), nor apostrophes ( '), Contain (:).

- You already have online or mobile banking and your very own login credentials.

- Use your current username and password to log in.

- You’re a joint account holder and haven’t set up a unique online or mobile banking login that is all your own.

- Click on "Or, Register with Online Banking" on the login screen.

- Enter your last name, Account Number (or Member Number on your statement) and Social Security number, which will be used to validate your account.

- Note that you’ll be prompted to enter a new username and password.

- You have multiple accounts and usernames of your own (For example, a personal and business account):

- Going forward, you’ll have ONE username and password to access all your accounts upon login.

- Enter one of your current usernames for your first-time sign-in — and if it isn’t recognized, try the other (our system is auto-selecting one, for security purposes).

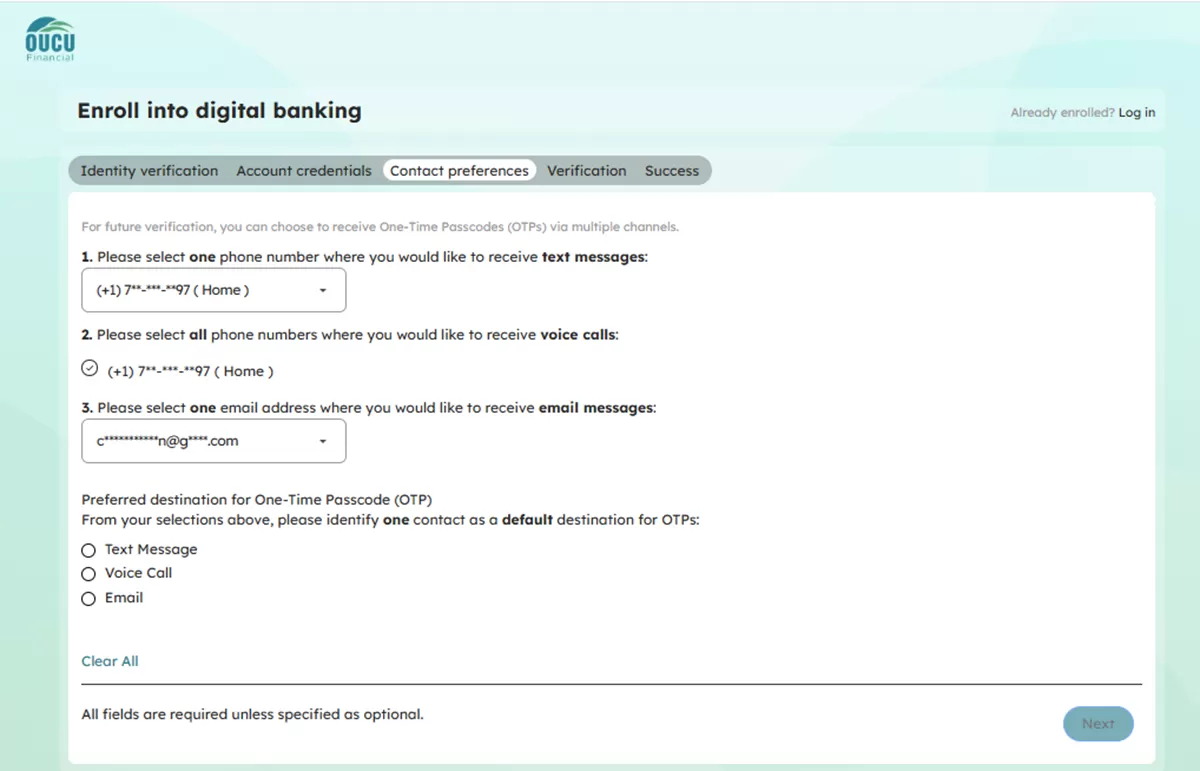

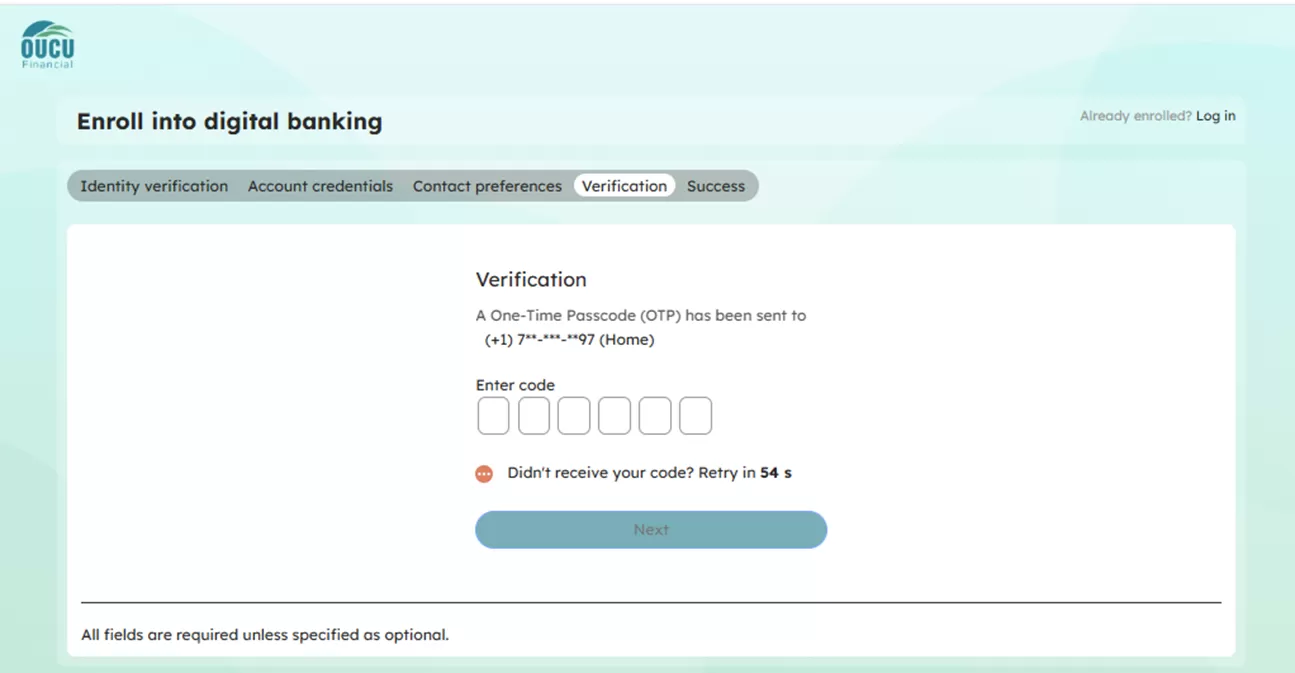

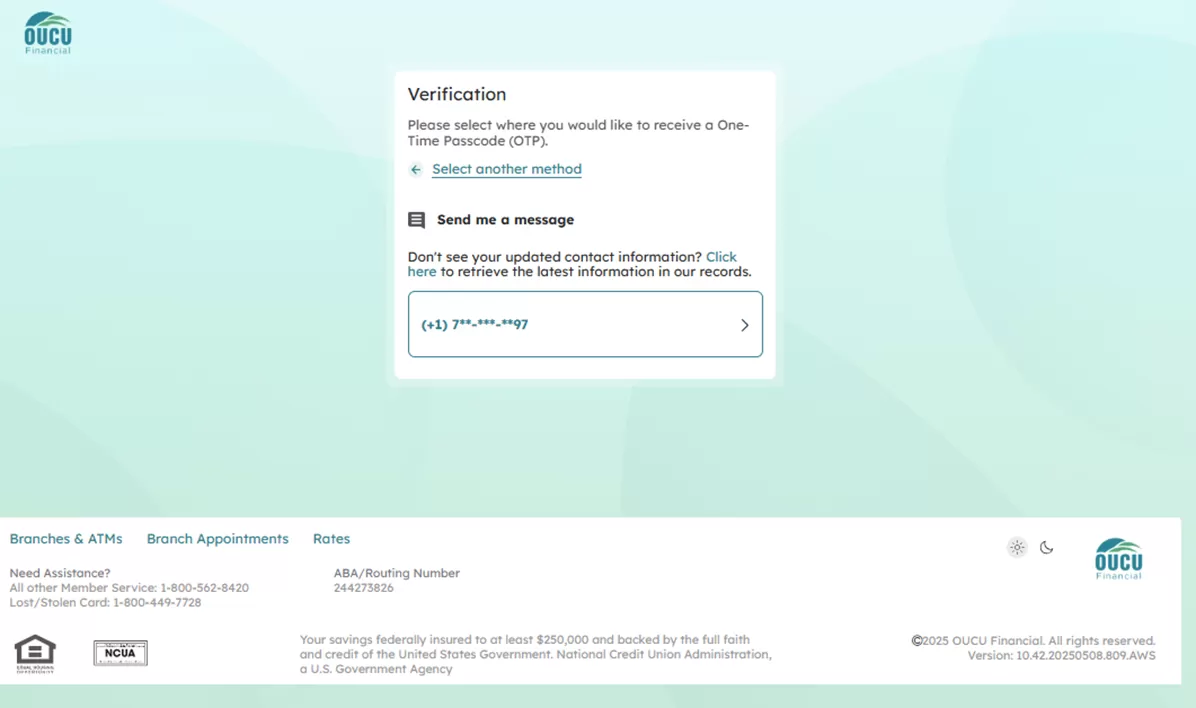

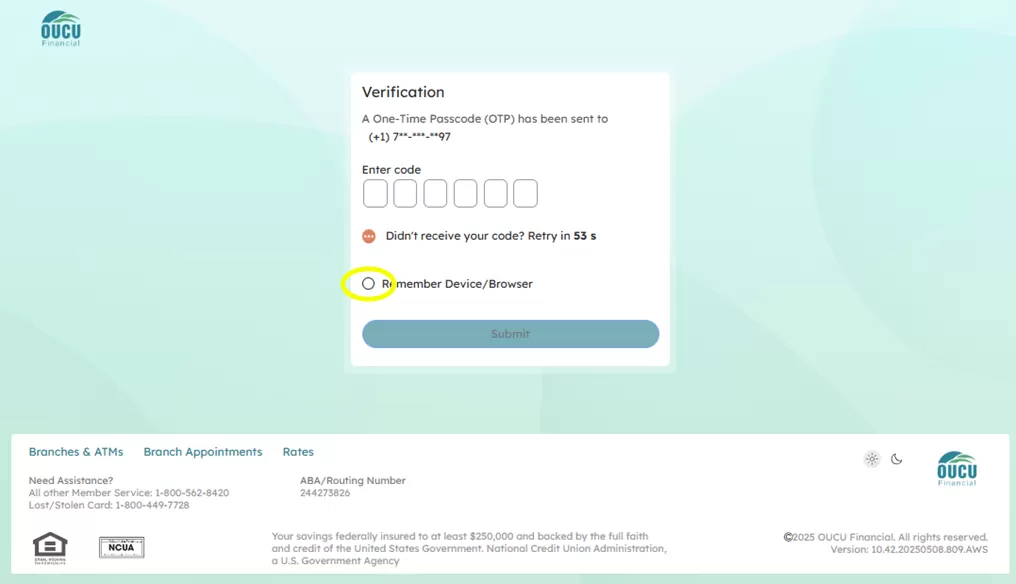

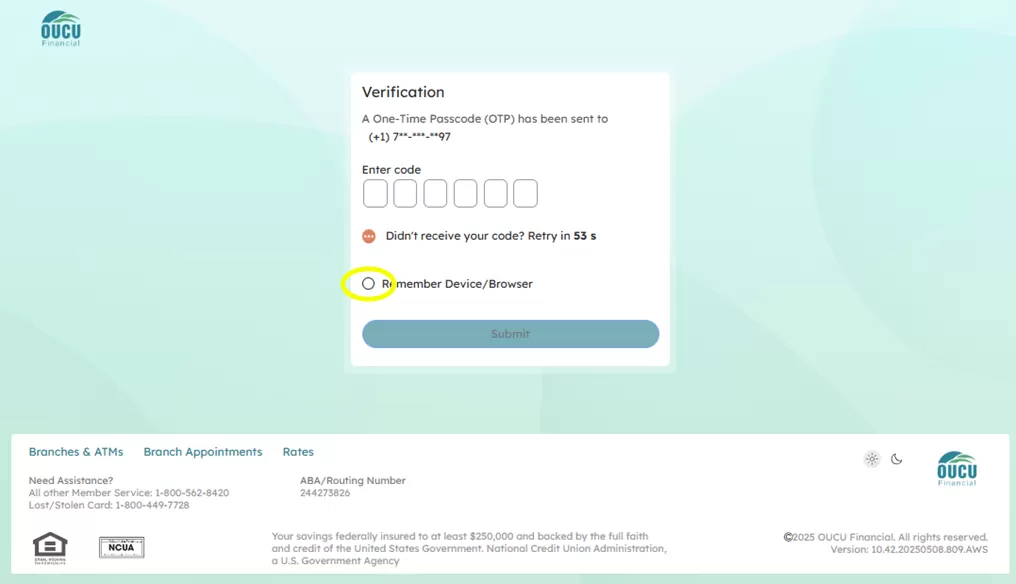

3. Verify your identity. Verify your identity with a secure, one-time PIN, texted or emailed to your account contact info.

*Make sure your contact information is accurate to ensure a seamless experience. If you have not updated your information and need to, please call OUCU at (740) 597-2800.

*For your security, don’t give your login credentials to anyone!

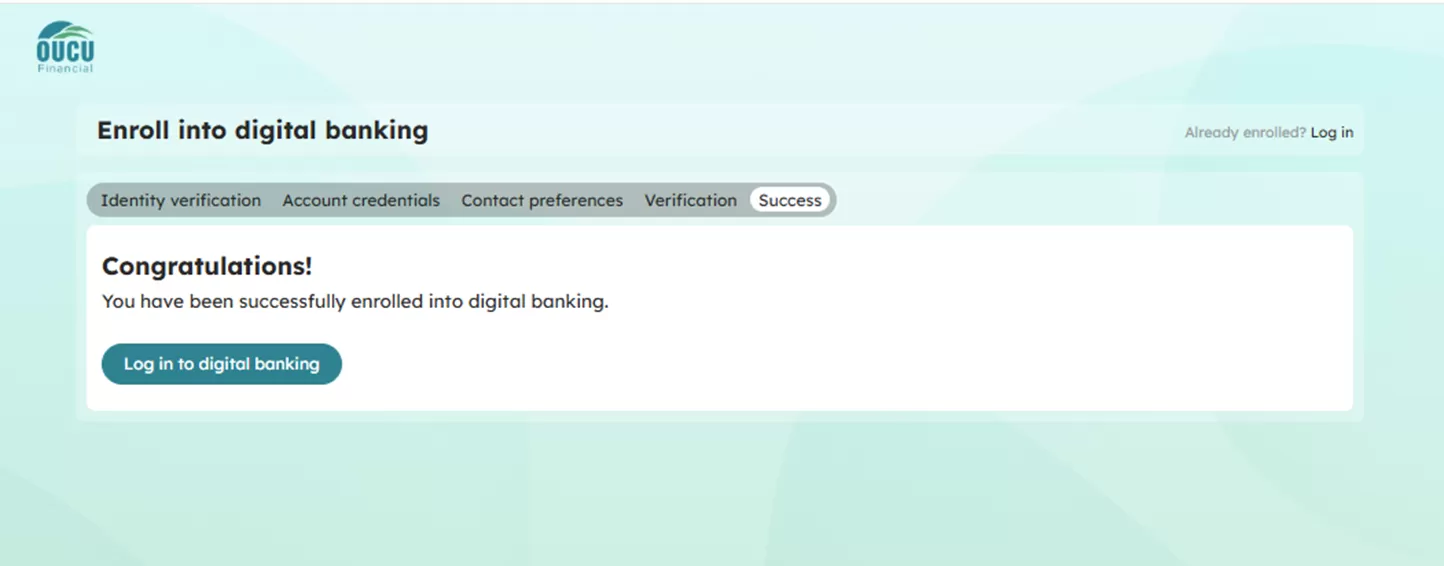

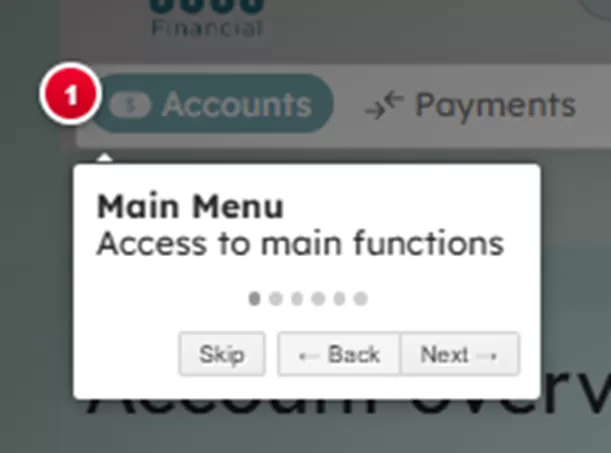

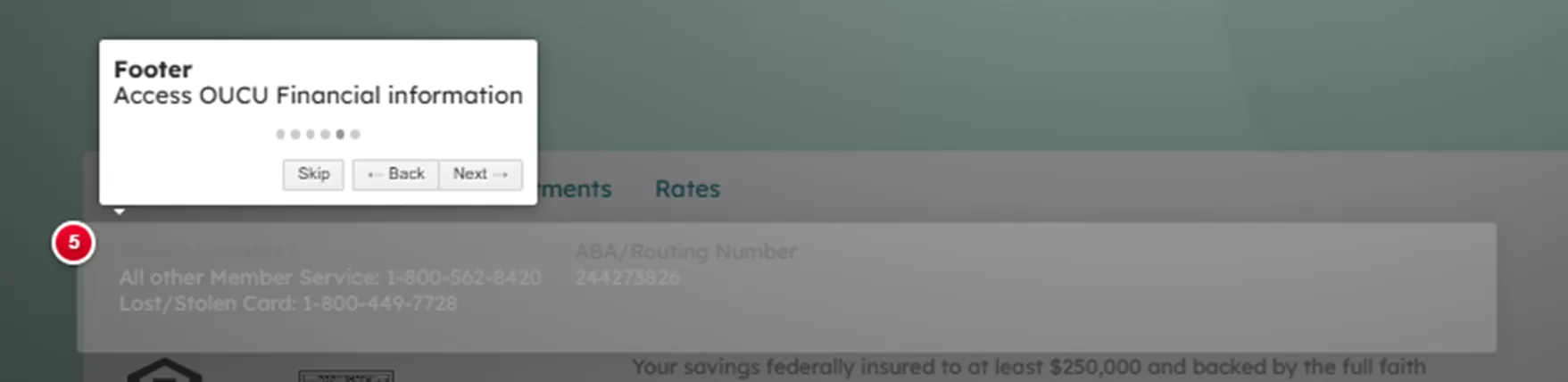

4. You’re logged in — enjoy your new online or mobile banking! Enjoy seeing ALL the OUCU accounts and explore this revolutionary new way of managing your money!

ONCE YOUR LOGGED IN

1. Review your personal information. > NEXT

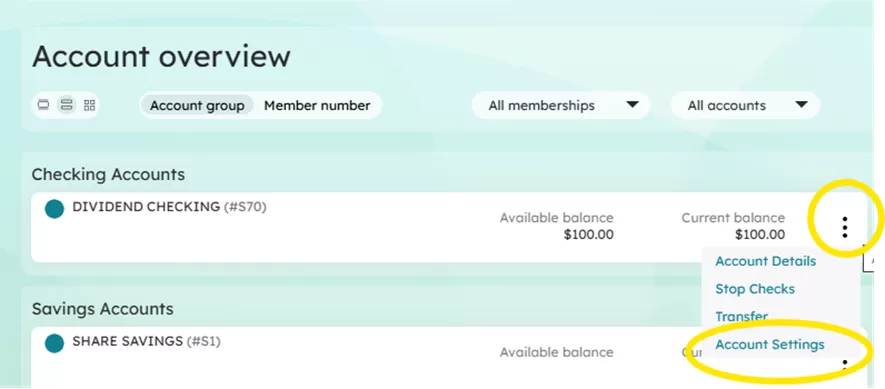

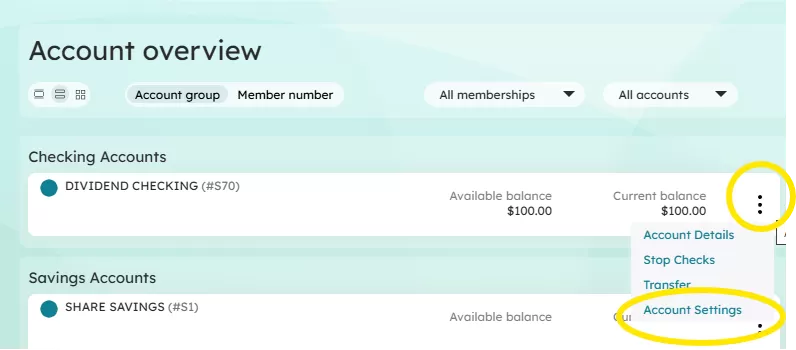

2. Select your preferred accounts for the following activities. Although, this step is optional and can be done later via Account Settings. > PROCEED TO DIGITAL BANKING

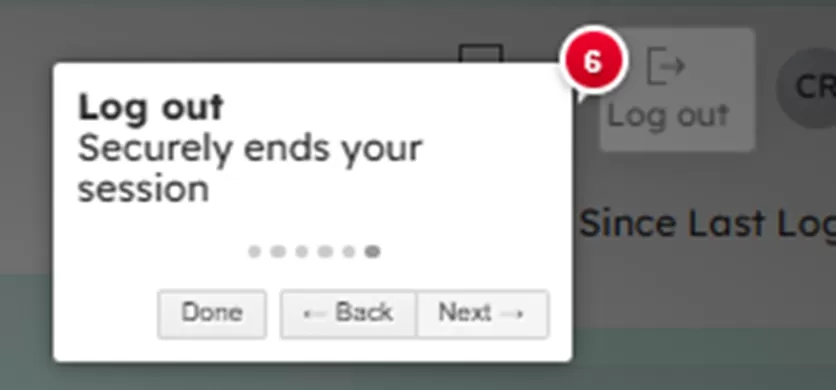

Step-by-Step Built -In Guide:

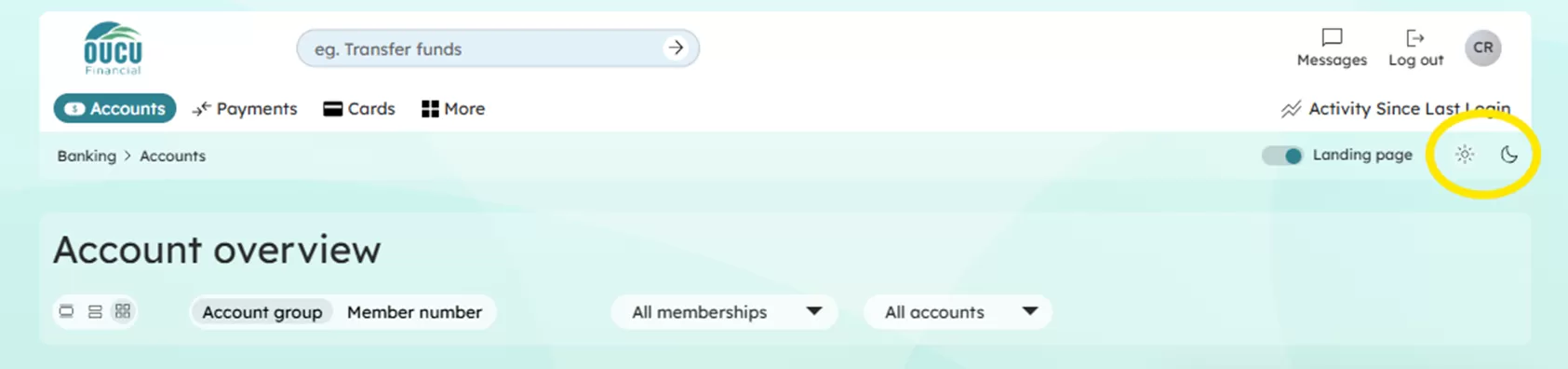

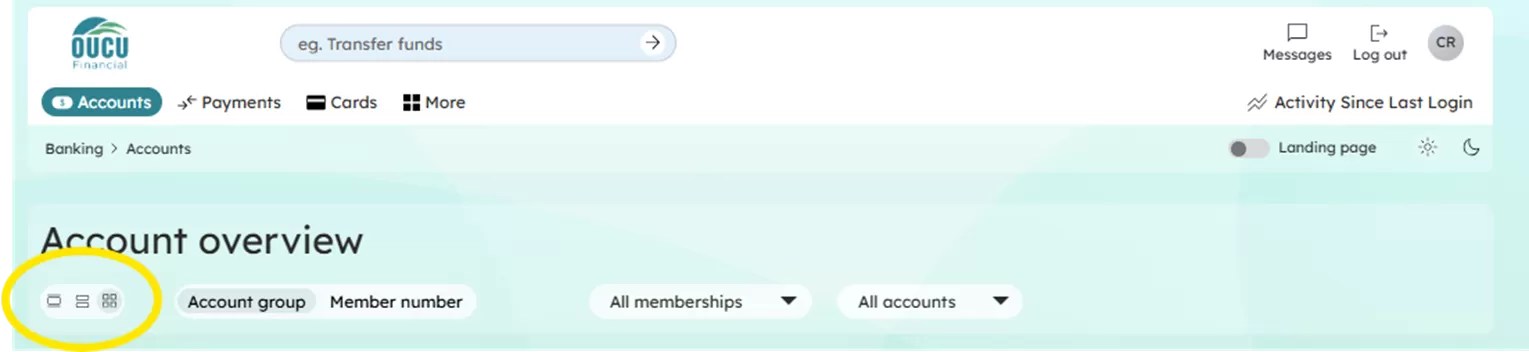

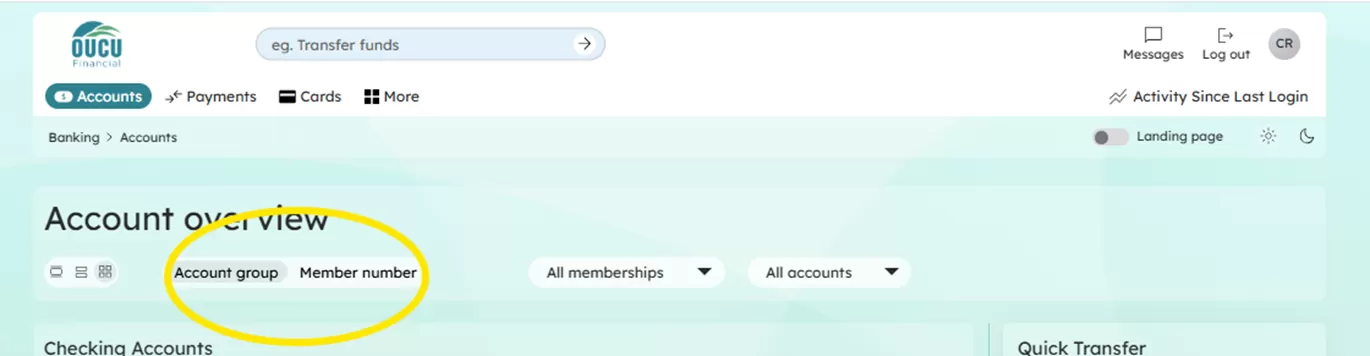

CUSTOMIZE YOUR DASHBOARD

It’s easy to switch between your accounts and move things around to put focus on the ones you use most!

• Light and dark mode

• Account Display

Choose between full, slim, compact views as per the level of details the user prefers to view.

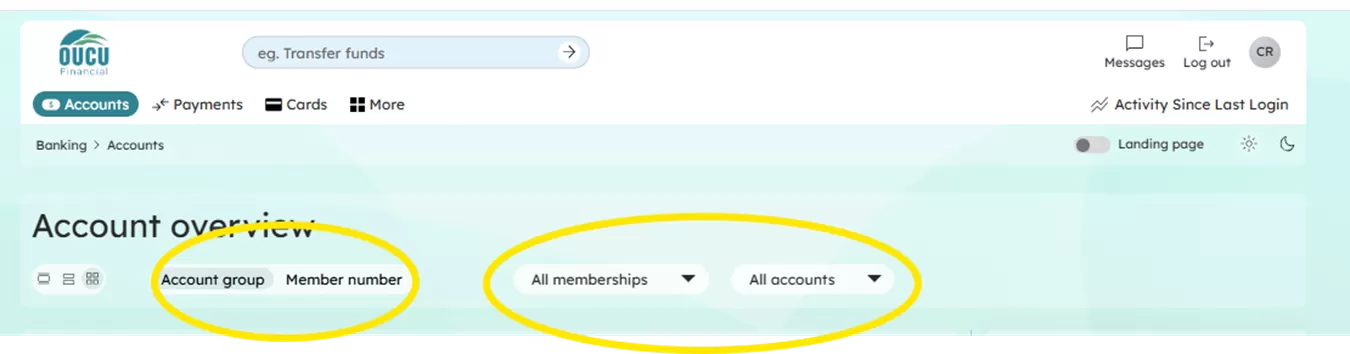

• View by Account Group or Member Number

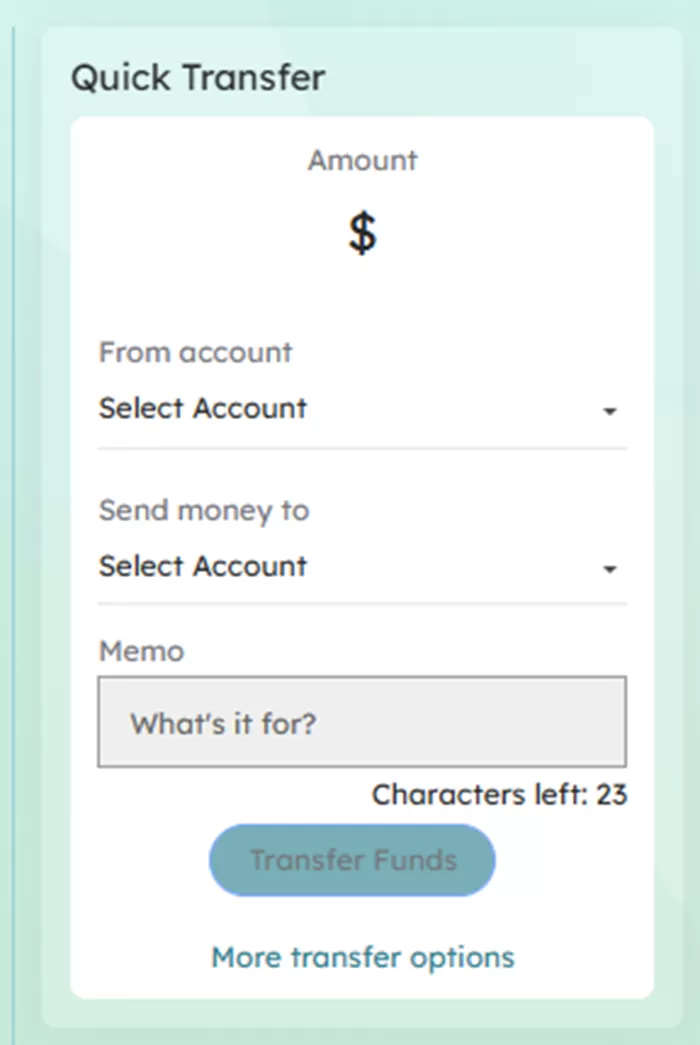

QUICK TRANSFER WINDOW

Select more transfer options from Quick Transfer window OR select Payments tab

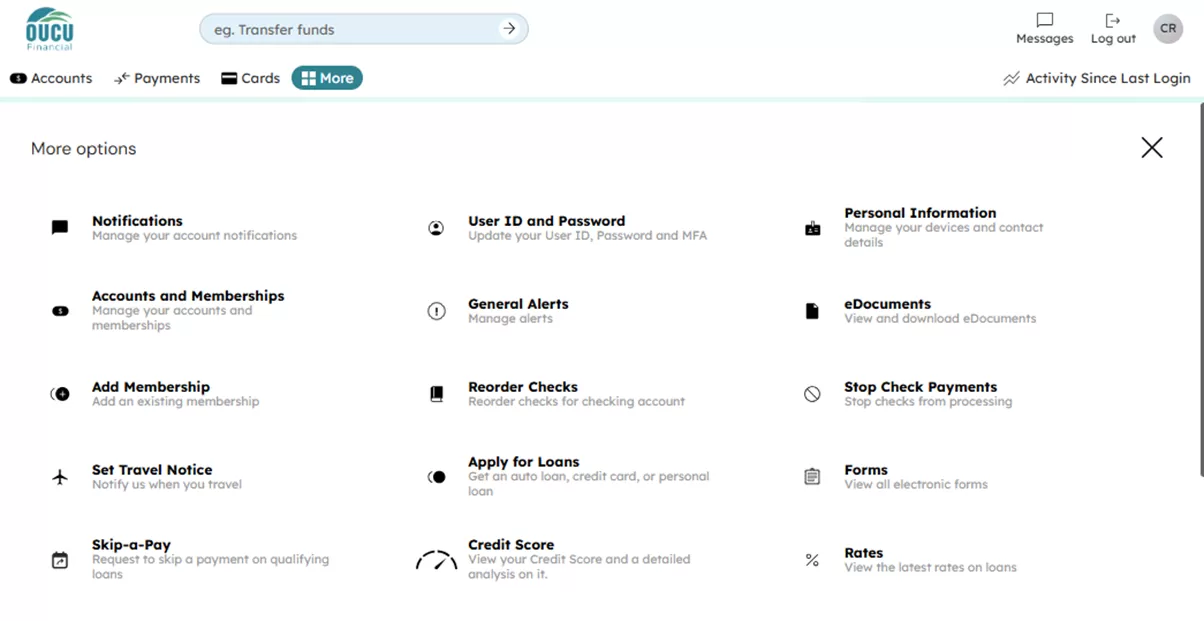

MORE OPTIONS

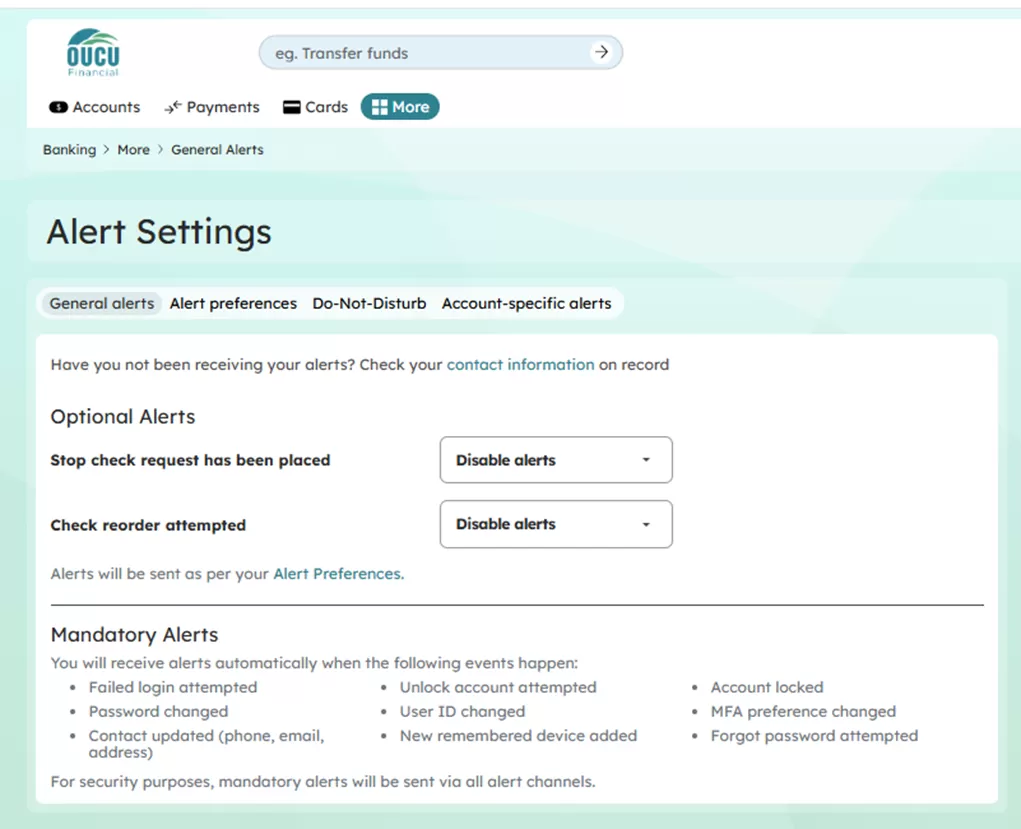

ALERTS

GENERAL FAQ’s

Have Questions? WE HAVE ANSWERS!

Why the Switch to New Online and Mobile Banking?

We're always looking for more ways to make your money management feel simple and stress-free. Your new digital banking will make it even easier to manage your total financial picture in one place.

When Do I Switch to the New Online and Mobile Banking?

Our new digital banking launches on June 23, and you’ll make the switch the first time you log in to your online or mobile banking on or after June 23.

How Does the New Online and Mobile Banking Keep My Information Secure?

Yes, your security’s always our top priority and there are many systems in place to protect your information, including multi-factor authentication. The first time you log in to your new online or mobile banking, you’ll be prompted to verify your identity with a secure, one-time PIN, texted or emailed to your account contact info.

Will Bill Payer Info Carry Over?

Yes, any payees or payments you’ve set up in Bill Payer will transfer over to new online and mobile banking, and you’ll enjoy all the same easy bill pay capabilities you have now.

Will Scheduled Transfers I Already Set Up in My Current Digital Banking Carry Over?

Yes, all your scheduled transfers you’ve set up in in your current OUCU online and mobile banking will carry over to the new digital banking platform and you’ll enjoy all the same easy transfer capabilities you have now.

Will My Account Nicknames Carry Over?

Yes, any nicknames you’ve created for your OUCU accounts, subaccounts or loans will

show up right away in your new online and mobile banking.

*PRO TIP:

If you haven’t already, we highly recommend using this feature! We know how motivating it can be to have account names to help you reach your goals, like “College Fund” or even “Toes in the Sand” for a vacation.

Can I Use New Digital Banking on Any Mobile Device?

OUCU digital banking is accessible using a smartphone, tablet or other mobile device with iOS (Apple) or Android versions. Since our new mobile app features the latest technology, you may not be able to download or use it on a device with an older operating system. If updating your device’s mobile operating system to a more recent version of iOS or Android is not an option, you can still enjoy digital banking convenience through OUCU online banking via web browser access.

Can I Use Biometrics (Face or Fingerprint Recognition) to Log In to OUCU’s New Digital Banking?

The first time you log in to your new OUCU digital banking, you won’t be able to use your fingerprint or face recognition for access but it may be an option for you on your second login.

Your ability to log in through face recognition (Face Unlock) depends on your device.

Will I still need to access CU Rewards page to redeem my rewards points and cashback?

Yes, BUT you can easily find the direct link to CU Rewards with your card details in digital banking.

BUSINESS FAQS

How Will This Affect Any External Financial Apps I’ve Linked To?

If you’ve linked to your OUCU online banking account from budgeting, accounting or

other “outside” applications, you'll need to re-link your OUCU accounts in your new online

or mobile banking.

How Will This Affect My OUCU Business Accounts?

Our new online and mobile banking makes business easier, too! As we continue to build this digital banking platform to fit your business needs, look for Treasury Management services, like ACH, wires, remote deposit capture or to be released in the future! We encourage you to back up QuickBooks and do a final transaction download.

TROUBLESHOOTING FAQS

Why Don’t I See All My Accounts in My Dashboard?

If you don’t see your credit card, mortgage or other accounts in your dashboard, simply adjust your account view settings: Account Group/Member number or the All Memberships and All Account drop-down for more options.

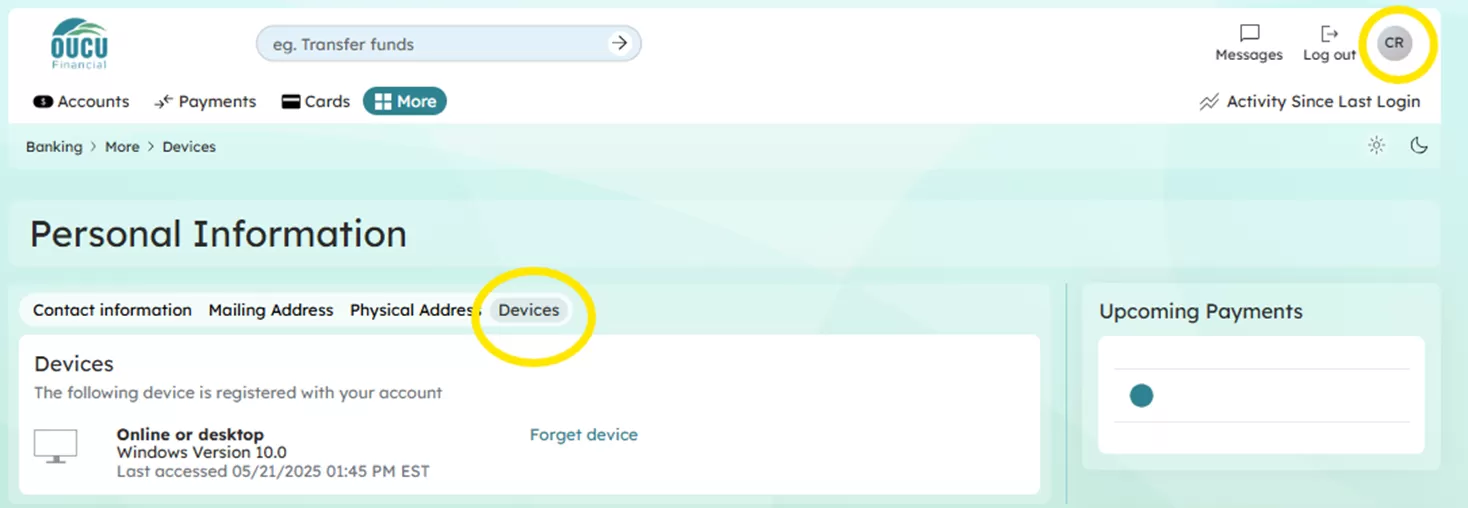

Set trusted device

Select "Remember Me" when logging in to add save your username and password on a trusted device.

Manage the devices registered with your account.

Fingerprint/Touch ID & Face ID

Enable fingerprint/Touch ID or Face ID in your device's settings to use those features in the OUCU Banking app.

Missing text

If text appears to be missing or is cut off, check the font size setting in your device.

Can't select birthday

Toggle your birth year first for optimal results when selecting date of birth.

Autofill fields

If you are experiencing issues with your browser auto-filling fields incorrectly, disable or clear the auto-fill/auto-complete settings in your browser.

Turning Off Autofill in Chrome

1. Click the Chrome menu icon. (Three dots at top right of screen.)

2. Click on Settings.

3. In the “Autofill” section, expand the area for which you wish to disable Autofill.

4. Toggle the setting OFF if it is on. The system will automatically save your settings.

Clearing Autofill Data in Chrome

1. Click the Chrome menu icon. (Three dots at top right of screen.)

2. Click on History, then click on History again in the menu that appears.

3. Select Clear browsing data.

(Alternatively, you can press CTRL+SHIFT+DEL on your keyboard to bypass steps 1-3.)

4. If it is not already selected, click on the “Advanced” tab.

5. At the top, choose “All Time” option to clear all saved data.

6. Make sure that the “Autofill Form Data” option is checked.

7. Click “Clear Data.”

Turning off Autofill in Firefox

1. Click on the Firefox menu icon. (Three lines at top right of screen.)

2. Click on Preferences.

3. Choose “Privacy & Security.”

4. In the “Forms & Autofill” section uncheck “Autofill Addresses.” The system will automatically save your settings.

Clearing Autofill Data in Firefox

1. Click on the Firefox menu icon. (Three lines at top right of screen.)

2. Click on Preferences.

3. Choose “Privacy & Security.”

4. In the “History” section, click on the “Clear History” button.

(Alternatively, you can press CTRL+SHIFT+DEL on your keyboard to bypass steps 1-3.)

5. In the “Time Range to Clear” dropdown menu, choose “Everything.”

6. Make sure “Form & Search History” is checked.

7. Click Clear Now.

Turning off Autofill in Internet Explorer

1. Click on the Tools menu icon. (Gear at top right of screen.)

2. Click on Internet Options.

3. Select the Content tab.

4. In the AutoComplete section click on Settings.

5. Uncheck Forms and User Names and Passwords on Forms.

6. Click OK in the AutoComplete Settings Window.

7. Click OK in the Internet Options Window.

Clearing Autofill Data in Internet Explorer

1. Click on the Tools menu icon. (Gear at top right of screen.)

2. Click on Internet Options.

3. Select the Content tab.

4. In the AutoComplete section click on Settings.

5. At the bottom of the AutoComplete Settings window, click Delete AutoComplete History.

6. Check Form Data and Passwords.

7. Click Delete.

8. Click OK in the AutoComplete Settings Window.

9. Click OK in the Internet Options Window.

Turning off Autofill in Edge

1. Click on the “Settings and More” icon. (Three dots at top right of screen.)

2. Click on Settings

3. In the “Your Profile” section, click on each of the following and be sure the option is toggled off:

o Passwords

o Payment info

Clearing Autofill Data in Edge

1. Click on the “Settings and More” icon. (Three dots at top right of screen.)

2. Click on Settings

3. Click on “Privacy, search and services.”

4. In the “Clear Browsing Data” section, click “Choose What to Clear.”

5. For the “Time Range”, choose ALL TIME.

6. Be sure “Autofill Form Data (Includes Forms and Cards)” is checked. If you wish to clear “Passwords”, be sure to check that option as well.

7. Click “Clear Now.”

Turning off Autofill in Safari

1. Click on the Safari menu. (The word Safari at the top of the screen.)

2. Click on Preferences.

3. Choose AutoFill

4. Uncheck “Using info from my Contacts Card/Address Book Card” and “Other Forms”

5. Click Done.

Clearing Autofill Data in Safari

1. Click on the Safari menu. (The word Safari at the top of the screen.)

2. Click on Preferences.

3. Choose AutoFill

4. Next to “User Names and Passwords” click Edit.

5. Click Remove All or find any information stored for iClassPro.com and remove it specifically.

6. Click Done.

LOGGING IN FOR THE FIRST TIME

What do I need to login the first time?

You will need to enter the following at first login:

• Member Number

• User ID and Password

• SSN

• Date of Birth

• Member number or Zip Code

What if I don’t remember my User ID?

You will need to contact us to retrieve your User ID. Please call OUCU (740) 597-2800 or visit your nearest branch for assistance.

Why do you need my SSN/TIN?

Your Social Security Number or Individual Taxpayer Identification Number, along with other criteria, will be used to verify your identity and to ensure only you are accessing your banking information. Modern encryption and security protocols are used to ensure your information is always safe and secure.

What if I don’t know my account number?

You can locate your account number on the bottom of your bank checks or on your most recent bank statement. You may also contact OUCU (740) 597-2800 or visit your nearest branch for assistance.

What is an OTP?

A one-time passcode (OTP) is valid for only one use. This passcode will be provided by text, email or phone call as an added layer of security.

Why didn’t I receive the OTP via text?

Please verify that we have the most up-to-date phone number on file.

• Mobile: Menu > Personal Information

• Online: More > Personal Information > Edit information

Why didn’t I receive the OTP via email?

Please verify that we have the most up-to-date phone number on file.

• Mobile: Menu > Personal Information

• Online: More > Personal Information > Edit information

SETTINGS & PREFERENCES

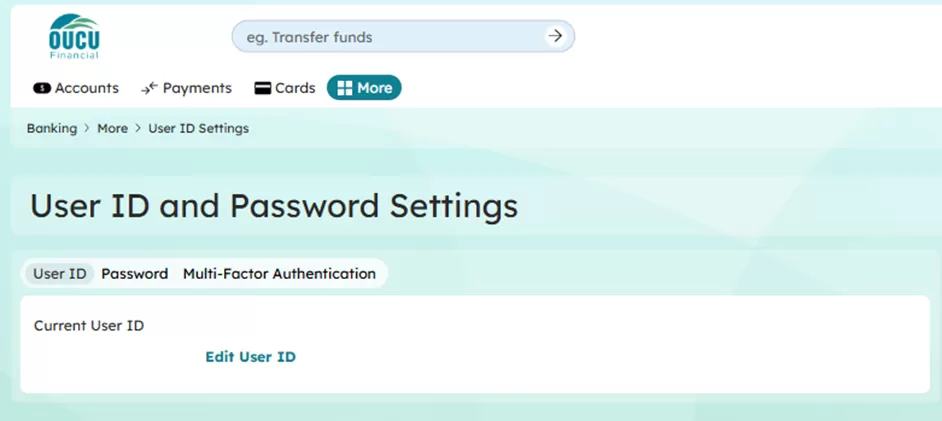

How do I update my User ID?

How do I update my Password?

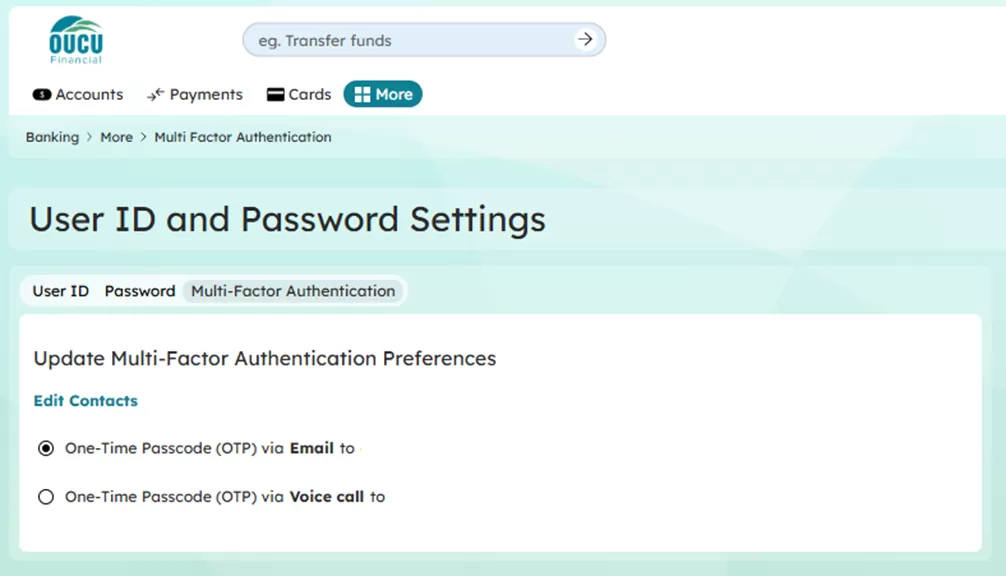

How do I update Multi-Factor Authentication Preferences?

How do I add a nickname for an account?

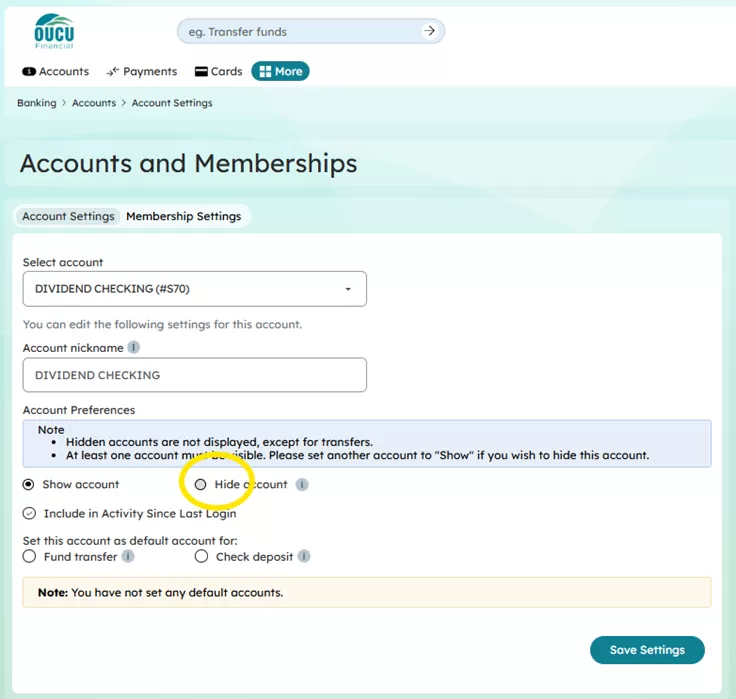

How do I hide an account?

How do I set my default page?

• Mobile: You may select your default page by holding your finger on the icon for the page you would like to select as your default page.

• Online: The Dashboard or Accounts page can be selected as a default page.

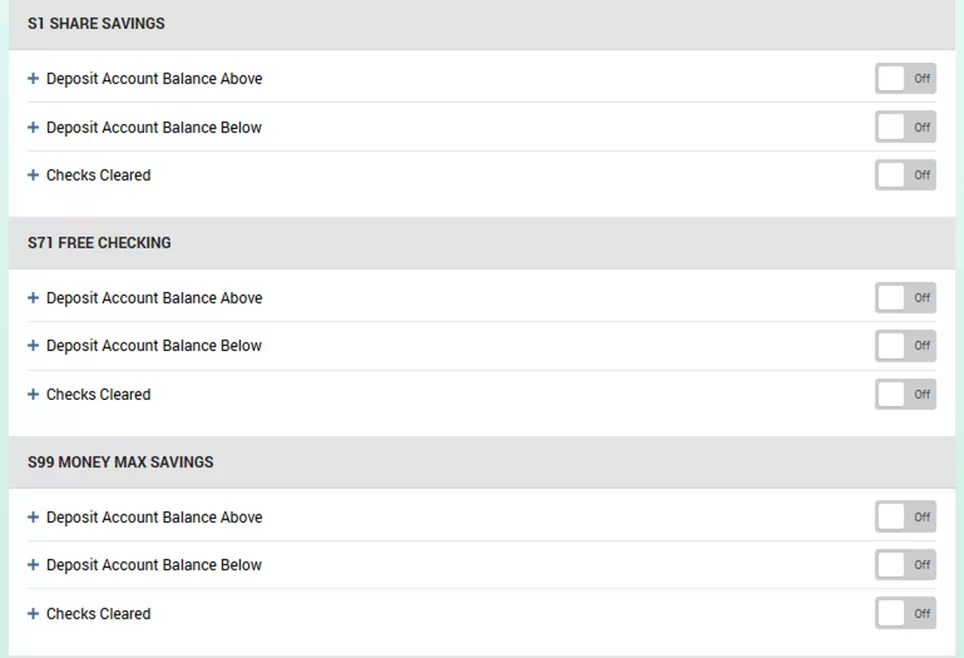

How do I set up/manage alert preferences?

• Mobile: Menu > Alert Settings

• Online: More > Alert Settings > adjust settings as needed

How do I update my contact information?

• Mobile: Menu > Personal Information

• Online: More > Personal Information > Edit information

How can I request help or ask a question about a transaction?

• Mobile: Select the Account > Review Transaction History > select a specific transaction

• Online: Review history in an account

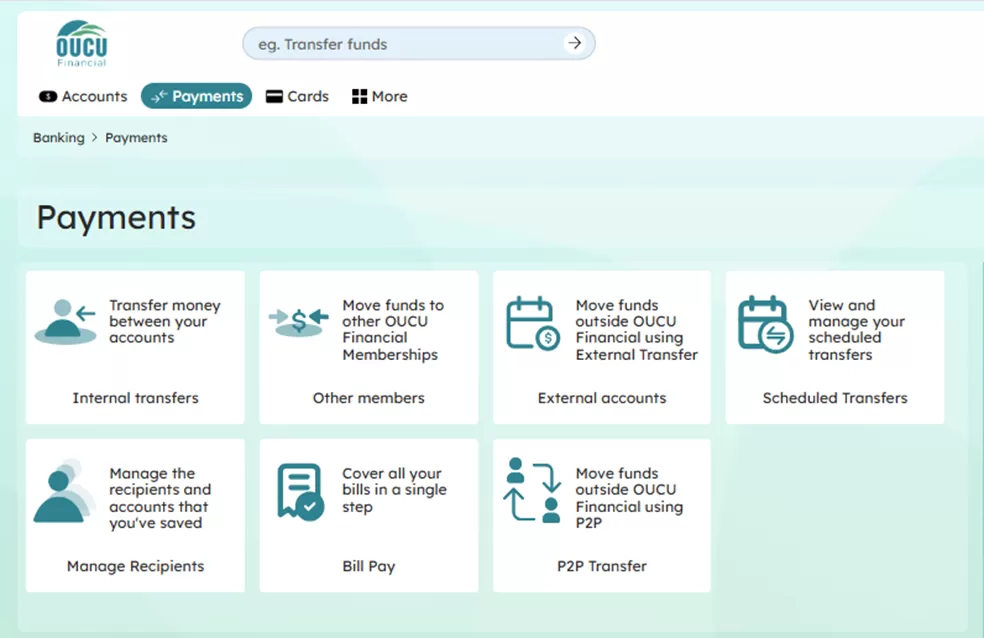

PAYMENTS & TRANSFERS

How do I set up Bill Pay?

If your payee is eligible for Bill Pay, you will need to provide the credentials to access the bill information for that payee.

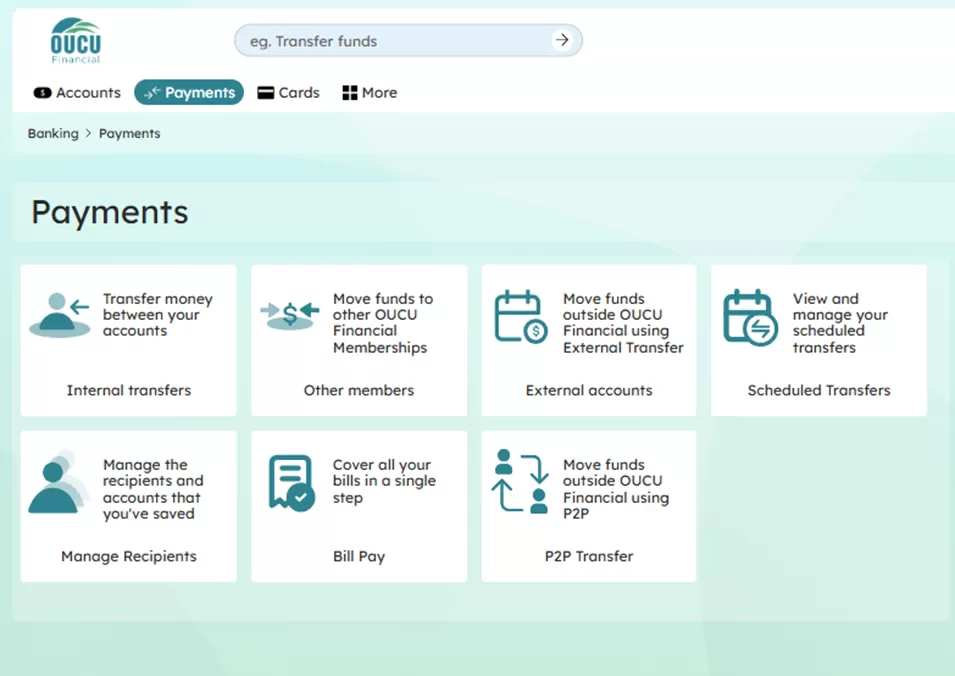

How can I transfer money between my OUCU accounts?

To send money from one of your accounts to another select transfer between my accounts and then select the account you want to transfer from, indicate the amount and date, select one-time or recurring, and then select the account you wish to transfer to.

How can I send or receive money to/from my account at another financial institution?

To add a new external account, you will need the account and routing number of your other account.

How can I pay another OUCU member?

To send money to another OUCU member, select Move funds to other OUCU Financial Memberships. Add the recipient using their name and account number.

How do I use mobile deposit?

1. Log into the app.

2. Select "Deposit" from the bottom navigation.

3. Choose account for deposited funds to go into.

4. Enter amount of the check.

5. Endorse the back of your check with your signature.

6. On a dark background, take a photo of the front and back of your check.

7. Click the Deposit Check button.

8. Retain your check in a safe place until it is reflected in your account balance.

ALERTS

How do I set up alerts or change my alert preferences?

• Mobile: More Menu > General Alerts

• Online: More Menu > General Alerts

How do I change or set Do Not Disturb?

• Mobile: More Menu > General Alerts > Do Not Disturb

• Online: More Menu > General Alerts > Do Not Disturb

Default is 10pm to 7am CST

You will not receive alerts between 10:00 PM & 7:00 AM the next day.

Do-not-disturb period does not apply to mandatory alerts. Mandatory alerts will be delivered to all alert channels as soon as they are triggered.

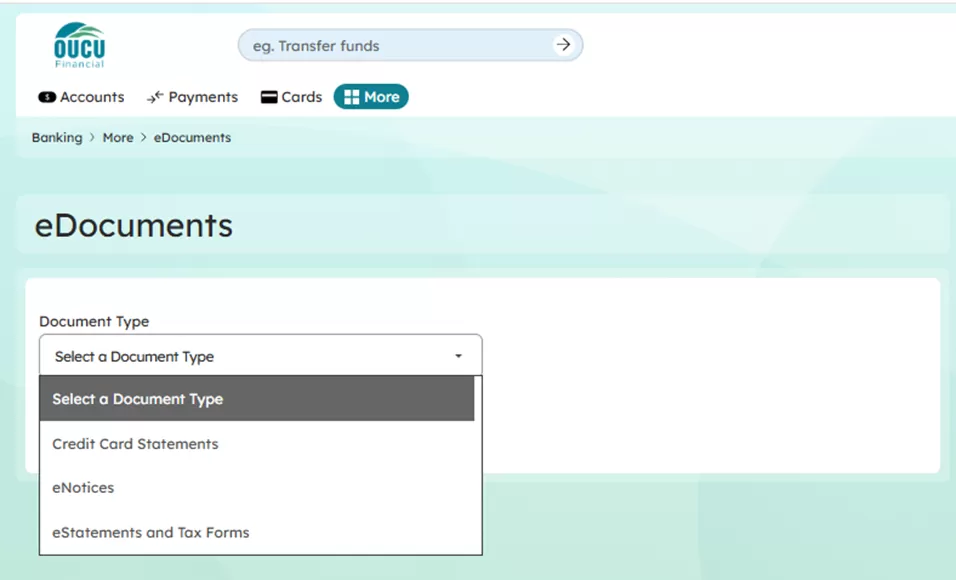

Where can I view my statements and other important documents?

• Mobile: More Menu > eDocuments > Select Document Type

• Online: More Menu > eDocuments > Select Document Type

CARDS

How do I activate my card and select a Personal Identification Number (PIN) in digital banking?

• Mobile: Menu > CONFRIM

• Online: More Menu > CONFRIM

How do I set alerts of travel plans in digital banking?

• Mobile: Menu > CONFRIM

• Online: More Menu > CONFRIM

How do I lock and unlock my cards in digital banking?

• Mobile: Menu > CONFRIM

• Online: More Menu > CONFRIM

Go to main navigation