Welcome, we are glad you're here!

Trusted advice and judgment-free financial guidance, OUCU supports your goals to achieve financial wellness at every stage in life.

Where are you on your journey to financial wellness?

A foundation of financial education has value beyond your bank account.

Build a Brighter Financial Future at any age.

Check out our Financial Wellness for Youth and Young Adults.

OUCU Financial Partner Resources

.png)

Making your financial goals happen, together. OUCU Financial members receive access to free financial counseling, debt management services, and student loan counseling through our partners at Greenpath Financial Wellness.

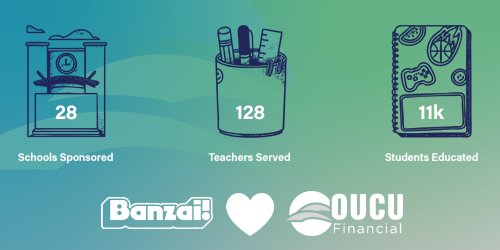

With Banzai, you have access to free, virtual, interactive real-world financial education for all ages!

Jean Chatzky knows that a full, successful financial life is within every woman’s grasp and she’s on a mission to help you get it.

Community Impact

Financial Education is one of the greatest gifts your credit union can give you.

Virtual Financial Education in our Schools

The Banzai classroom teacher program offers premade lesson plans and more.

Financial Education in the Community

Banzai allows us to educate and empower our community.